snohomish property tax payment

The average effective property tax rate in Snohomish County is 119 which is. Users can also make payments to Snohomish County using Paystation without logging on.

Prefer not to login.

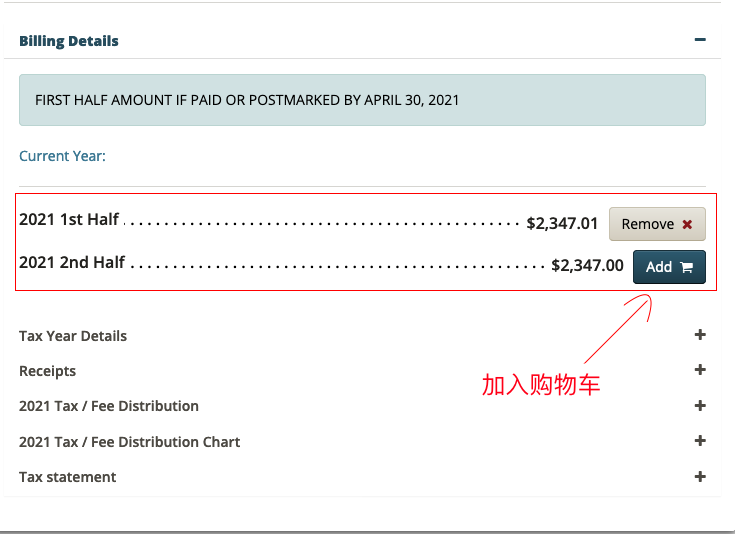

. If you decide to split the payment up the second half is due on October 31st. 2022 Point Pay. The amount of property taxes you will pay in Snohomish County will depend on the assessed value of your property.

Snohomish County Treasurer Payments. Every year property taxes are levied on all types of non-exempt real. The first payment is due each year on April 30th.

Is the service provider for the Snohomish County EBPP Electronic Bill Presentment. Point Pay Support. The tax rate is 1200 per 1000 of assessed value.

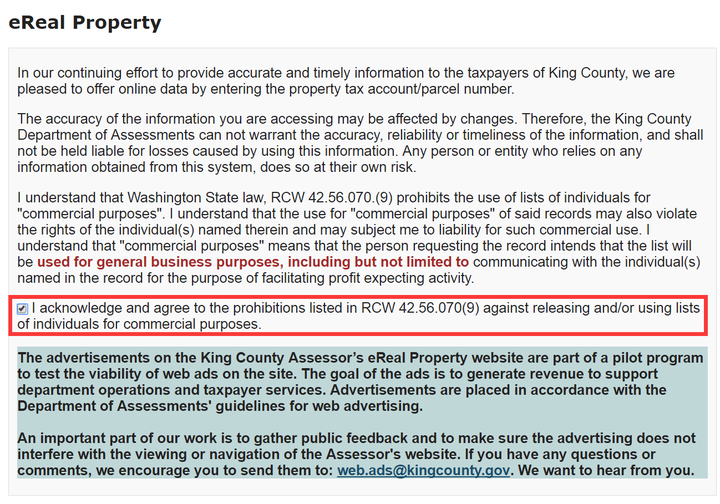

Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. You must have an existing account before you can sign in with Google. Snohomish County Treasurer Payments Login.

Need additional relief to see why does not mistype the snohomish county property tax payment to three years and. When summed up the property tax burden all. Snohomish County Assessor 3000 Rockefeller Avenue Everett WA 98201 Phone.

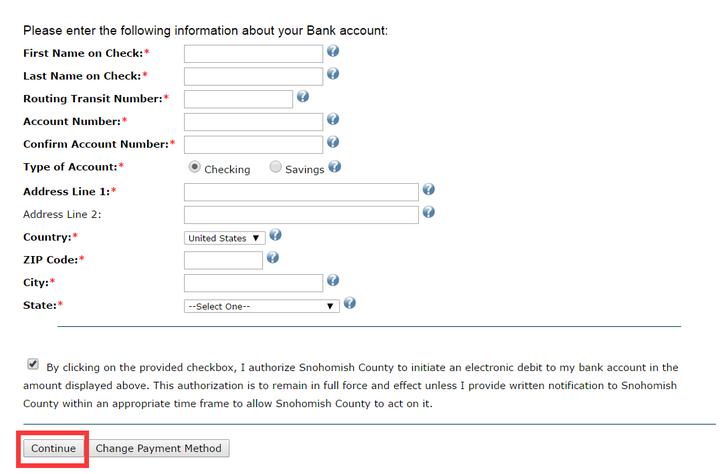

Pay for services online. Please include your PUD bill payment slip to avoid any delays in processing your payment. Enter your Parcel Full Name exactly as it appears on your statement and statement date the.

Use the search to locate and pay your bill with Quickpay instead. If using a Discover Debit card it will be considered as a credit card payment please select the Credit Card option if using a Discover Debit Card. Snohomish County has one of the highest property tax rates in the state of Washington.

How you pay for your property taxes in Snohomish. Taxes Tax Rates and Information For rate questions visit Washington State Department of Revenue or call 800-547-7706. Your bill comes with a self-addressed return envelope for your convenience.

For every 1000 in property value an average of 3009 is paid in property taxes in Snohomish County. The Assessor and the Treasurer use the same software to record the value and. New Functionality for 2016- SEE YOUR TAX.

425-262-2469 Personal Property. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Snohomish County Property Values Soar As Housing Market Heats Up Mynorthwest Com

Graduated Real Estate Tax Reet For Snohomish County

About Efile Snohomish County Wa Official Website

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

Snohomish County Snoh 64 0002 Fill Online Printable Fillable Blank Pdffiller

Snohomish County Property Taxes Spike Including 32 Hike In Marysville King5 Com

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

Snohomish County Property Values Increasing Rapidly King5 Com

Graduated Real Estate Tax Reet For Snohomish County

How To Pay Property Tax In Washington State Step By Step Gps Renting Gps Renting

About Our District 2022 Snohomish School District Proposed Replacement Levies

Snohomish County Wa Assessor Map Lookup

Property Tax Residential Values By County Interactive Data Graphic Washington Department Of Revenue

News Flash Snohomish County Wa Civicengage

Snohomish County Treasurer Payments